Utility-scale solar installers are well-versed in handling glass-glass (or dual-glass) solar panels. These panels use a second glass layer on their backsides instead of traditional polymeric backsheets. Uncovering a solar panel’s backside is obviously ideal for bifacial solar designs, where solar power can be generated from both sides of the solar cells. Bifacial solar panels are abundant on utility-scale projects, especially when the panels can be tilted and spaced optimally for bifacial gains.

Credit: EightTwenty

But these once “niche” solar panels are becoming commonplace in more areas than just deserts and on tracking systems. Due to bifacial’s exclusion from Section 201 tariffs, a surge in imports of the specialty panel is hitting commercial and residential roofs too. According to data from the Dept. of Commerce, 32% of solar panels imported into the United States in 2021 were bifacial. One year later, 87% of imported modules were bifacial, and 93% were bifacial in the first half of 2023.

Most solar installers have now likely handled glass-glass panels, even when their bifacial attributes aren’t leveraged, as noted by Michael Perkins, senior VP of business development for commercial contractor Radiance Solar.

“We have utilized bifacial panels on projects, even a rail-mount roof array. This was driven less by the albedo effect than by the cost of the modules themselves. For a while, the bifacial exemption on tariffs made them cost-competitive,” he said.

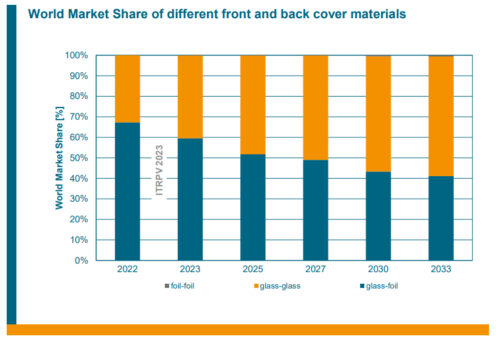

Using bifacial modules on flush-mount roof projects may seem pointless, but trends show glass-glass panels are becoming more prevalent in general. The 14th edition of the “International Technology Roadmap for Photovoltaic (ITRPV)” report expects glass to become the dominant back cover material by 2027. This is largely due to bifacial cells becoming the default choice. Bifacial cells held 70% of the market in 2023 and will increase further to 90% within the decade, ITRPV reports. If a solar panel manufacturer is going to the trouble of using bifacial cells, they might as well show them off in glass-glass formats.

Meyer Burger has gone all-in and announced in early 2023 that it would only make glass-glass modules moving forward. The company noted many benefits to customers for the switch, including improved performance, reliability and stability for its specialized heterojunction technology (HJT) modules without polymeric backsheets. Meyer Burger also improves the panel’s warranty from 25 to 30 years when forgoing the backsheet.

“Glass is the ideal backsheet. It stands up better to the weather, to heat, to moisture,” said Michelle Graef, Meyer Burger senior marketing manager for the Americas. “If it’s not a flush-mount, everyone is already asking for glass-glass. This is the forefront of the industry moving to glass-glass.”

Manufacturing exclusively glass modules has also helped Meyer Burger increase production speeds at its factories.

“They don’t have to change their lines anymore, switching between backsheet and glass,” said Anne Schneider, Meyer Burger global head of communications and PR. “We are highly optimized; it’s 24/7. When you have to stop and change to another process, it’s an interruption. To be more effective on the production side, glass-glass is a good [technology].”

This automated manufacturing process with fewer interruptions is better at preventing microcracks from forming during production too. Quality assurance group Clean Energy Associates (CEA) has found dual-glass panels perform better in the field by removing the potential for backsheet failures, but there’s still the potential for issues.

“For glass-glass modules, we see fewer microcracks forming during installation as well as less growth of existing microcracks than in comparable glass-backsheet modules,” said Claire Kearns-McCoy, engineering services manager with CEA. “However, the risk of glass breakage is higher in glass-glass for modules with thinner glass.”

Polymeric backsheet panels are typically matched with 2.8-mm or thicker glass. Glass-glass panels have shrunk each glass layer to 2-mm to reduce weight. Having glass on the backside prevents problems associated with flexible and penetrable backsheets, but even a slight change in the frontside’s thickness brings up a new set of issues.

“This creates a lot of issues in hail-prone areas, but also in general with unexplained, spontaneous breakage,” said George Touloupas, senior director of technology and quality at CEA. “This may be due to variability of glass production, installation practices and, potentially, unsuitability of current IEC test methods. This is a very hot topic in the industry now and has not been yet resolved.”

Due to those issues, glass can’t go any thinner, so the two layers will likely remain the heaviest portion of the finished panel. Right now, there is no way around it — glass-glass panels will be heavier than those with backsheets. When comparing Trina Solar’s modules of the same dimensions, its glass-glass modules are 9 lbs heavier than those with backsheets. Similarly, Meyer Burger’s dual-glass panel is 53.8 lbs compared to its 43.4-lb backsheet module.

Perkins at Radiance Solar said that weight difference shouldn’t be forgotten, as it drives down productivity, especially in the latter part of the day.

“Techs just get tired, and an extra 5 to 10 lbs per module when you’re placing 85 a day can add up. Your install rate in the morning may be 10 per hour, but that can drop over the course of the day,” he said.

What can solar installers do about the proliferation of less-than-perfect solar panels for rooftop installations? It’ll be important to note the glass thickness of certain brands when working in challenging locations and be ready for heavier installations. Mounting systems will also need tweaked to prevent panels from bowing at the middle. Glass-glass panels are here to stay, and installers must adapt and stay safe.

“It is important to make sure that all installation personnel are trained and are adhering to the manufacturer’s handling and installation guidelines as well as general good handling practices for PV modules,” said Kearns-McCoy with CEA.