Ohm Analytics reported that the 2.3 GW of distributed generation, which includes rooftop solar, deployed in Q4 2023 marked the end of a long period of growth. Roth MKM warns that if a turnaround does not occur soon, residential solar could decline by 20% to 30% in 2024.

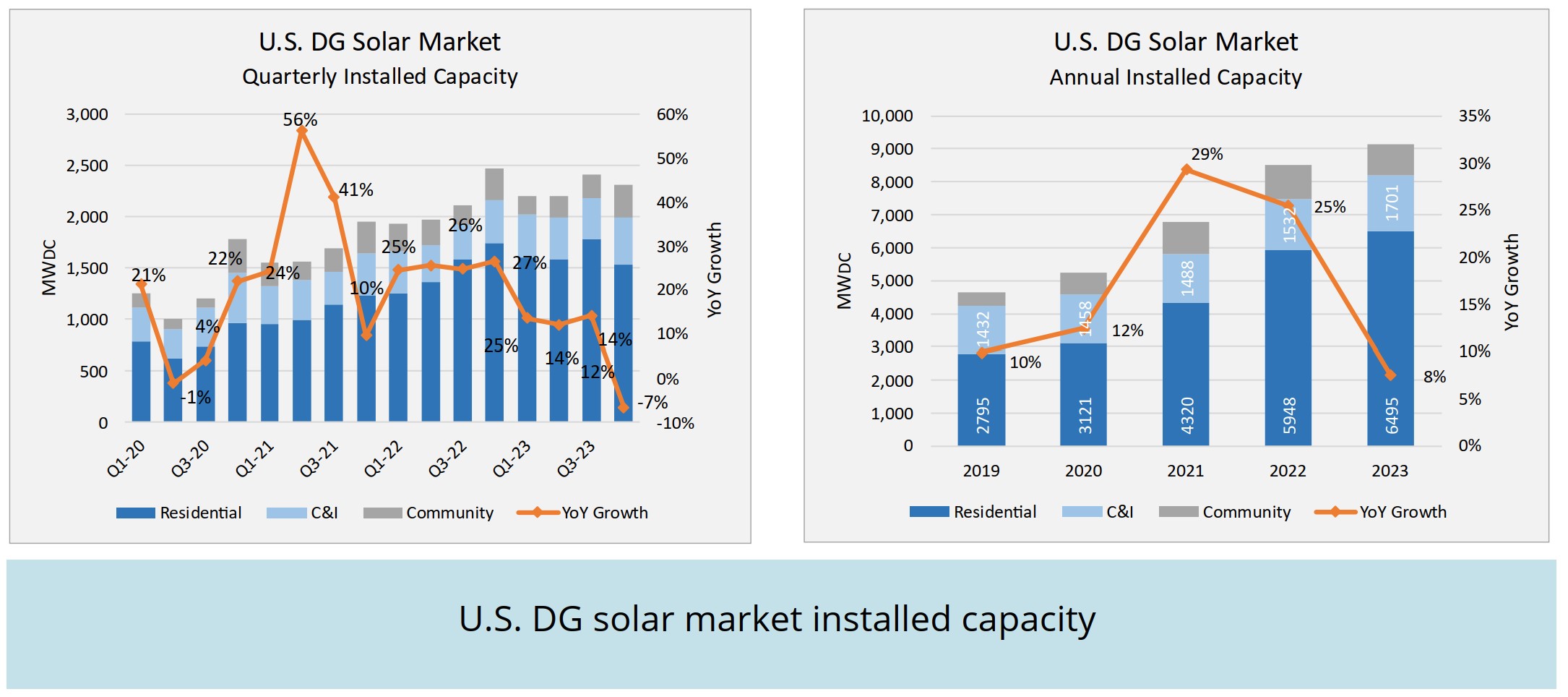

The distributed solar industry has experienced significant growth in recent years, with Ohm Analytics showing a more than a doubling of quarterly capacity since 2020. This growth was built atop residential solar, which itself had more than doubled its deployed capacity. However, 2023 witnessed a slowdown in distributed generation’s growth, falling to 8% compared to 2022, with the fourth quarter experiencing a 7% contraction.

As the residential sector’s doldrums from the fourth quarter extend into 2024, the industry is left to ponder the extent of the potential contraction and whether commercial, industrial, and community solar segments will play a larger role in sustaining the market.

The Ohm Analytics’ Annual 2023 DG Solar and Storage Report revealed that in recent history, the residential sector has been the growth engine for the smaller (residential, commercial, industrial, and community solar) sectors. (These sectors differ from the ‘utility’ sector, which is larger than all distributed sectors combined and connects to the wholesale electricity market.) In Q4 2023, it was growth in smaller commercial and industrial sectors at 9%, and community solar at 3%, that softened the impact of residential falling by 12%.

Last year’s decline in residential solar was driven by rising interest rates, which forced slower moving finance companies out of business, and California’s decision to hit the brakes on net metering incentives. The switch to NEM 3 in California initially led to an increase in residential deployments as many rushed to submit applications before the April 14, 2023 deadline.

The fourth quarter slowdown was uneven across the nation, with states like Texas, Florida, and Arizona, which rely heavily on loans, being most affected. In contrast, northeastern states with higher costs continued to grow, with some partially developed states like New York and New Jersey growing by 20%, and early growth states like Pennsylvania seeing an 80% expansion.

Despite the challenges, with California’s NEM 3, a silver lining is emerging: the expansion of energy storage. Ohm noted that residential storage grew by 22% for all of 2023, with Q4 2023 seeing a strong 66% increase. This growth aligns with the fall in price of energy storage battery cells and the massive global expansion in 2023.

Roth MKM, informed by various industry inputs including Ohm Analytics consultations, anticipates more weakness in the residential solar sector in 2024. Initially, Roth predicted a 12% residential decline, but in January, they revised this to a potential 15% drop due to further declines in California (which were then ranging from 30% to possibly 50%). Now, without a turnaround by May or June, Roth believes the residential solar sector could fall by 20 to 30% from its 6.5 GW of deployed capacity in 2023.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.