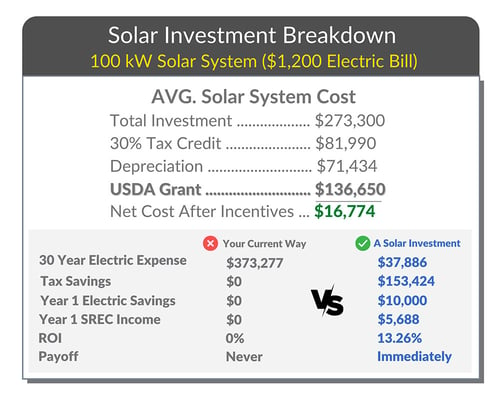

What if you could go solar for just 10% of the installation cost?

Sounds a little too good to be true. But for certain farms and rural businesses, this could be a reality thanks to generous tax and grant opportunities.

The USDA REAP Grant received additional funding for 2023 and 2024 and now covers up to 50% of solar installation costs. Coupled with incentives like the 30% Solar Investment Tax Credit and its 10% add-ons, local and utility grants, and bonus depreciation, 90% or more of installation costs can be covered.

The USDA REAP Grant received additional funding for 2023 and 2024 and now covers up to 50% of solar installation costs. Coupled with incentives like the 30% Solar Investment Tax Credit and its 10% add-ons, local and utility grants, and bonus depreciation, 90% or more of installation costs can be covered.

The trick is qualifying for and receiving this coveted grant. It’s expected that interest in these grants will be high, meaning the chances of snagging one of these half-off grants could be slim. That said, someone has to get them, and you want to know if that’s you.

In this blog, we’ll lay out everything you need to know about the grant, who qualifies, and how you can apply, including:

What is the USDA Grant for Solar?

The USDA’s Rural Energy for America Program (REAP) gives grants to agricultural producers and rural small businesses for energy-efficiency improvements and renewable energy projects. As of summer 2023, these grants can cover up to 50% of the total installation cost of your solar system (up to $1 million).

Add that to the savings from other incentives, and you’re talking about the vast majority of your solar system being paid for.

Who Qualifies for a USDA REAP Grant?

Eligibility requirements have changed since the REAP Grant’s previous iteration. In short, most farms and rural small businesses in an eligible area could qualify.

Farmers (Schedule F)

If you use Schedule F, you will be filing as an agricultural producer. To qualify, the majority of your income (51%) must come from the farm. Additionally, the majority of the electricity you use (51%) must be consumed by farm operations — not by personal residences attached to the property. Any electricity you use for your residence will not count toward your 51%. You also need to be free of any owed back taxes to the IRS.

Businesses (Form 1065 or 1120)

If you file a 1065 or 1120, you will be applying as a rural small business. The rules for qualifying are similar to those of farms: the majority of electricity consumed on the property must be for business purposes only, and the applicant can’t owe any back taxes. Most businesses that operate out of your residence do not qualify.

In addition, the business must be located in a qualifying area. The USDA defines this as an area with a population of 50,000 residents or less. You can use the USDA’s Eligibility Map to determine if your business is in a qualifying area. If your property is close to a qualifying area, but it’s not quite within the shaded portion, check with a USDA Grant professional to determine whether or not it qualifies.

When Can You Apply for the USDA Grant?

In previous years, the USDA Reap Grant covered a smaller percentage of a project, and grant submissions were split into two rounds. But with additional funding from the Inflation Reduction Act, the program has boosted its grant size and increased the number of rounds. From summer of 2023 to the end of 2024, you’ll have five chances to qualify:

- Q1, July–September 2023

- Q2, October–December 2023

- Q3, January–March 2024

- Q4, April–June 2024

- Q5, July–September 2024

How the USDA REAP Grant Rounds Work

Anyone looking to qualify for a REAP Grant has to submit their application in a specified round. A certain portion of the grant’s funding is split between each round. The funding will then be allocated to qualifying businesses and farms through the REAP Grant.

If there are more qualifying systems than the round’s budget can serve, the highest-scoring applications will receive the grants first until the funding runs out. The likelihood of every qualifying applicant receiving their grant amount is entirely dependent on how many systems apply. In the past, it wasn’t a sure bet that you’d receive the grant. But with the additional funds granted to the program, only time will tell how easy it will be to receive the grant.

If you don’t receive the grant in the round you applied in, you are eligible for grants in subsequent rounds. Your application will automatically roll over to other rounds in the same calendar year. For example, if you apply to the Q1 round and don’t receive the grant, your application will automatically be rolled over into the Q2 round.

However, if you don’t get in on a 2023 round, you will have to reapply to participate in 2024’s rounds.

Unlike years past, all rounds will be open to projects of all sizes. However, the July-September 2023 round will be the only round with a special allocation for projects under $20,000. If your project falls into this category, you may want to apply for that round specifically.

How Does USDA REAP Grant Scoring Work?

The scoring criteria for applications have changed slightly in 2023 for these six new rounds. Your application will be evaluated and ranked based on the following:

- Environmental Benefits (5 points) – You’ll receive points if your project has a positive effect on resource conservation, public health, and/or the environment.

- Energy Generated, Replaced or Saved (25 points) – You’ll receive points depending on how much or the percentage of energy you’re generating, replacing, or saving.

- Commitment of Funds (15 points) – The higher the percentage of funding for the project you have, the more points you’ll receive.

- Previous Grantees and Borrowers (15 points) – You’ll get the most points if you’ve never received the grant. You’ll receive none if you received this grant less than 2 years ago.

- Existing Business (5 points) – You’ll get points if you meet the definition of an existing business.

- Simple Payback (15 points) – The shorter your system’s payback, the higher the points.

- Size of Request (10 points) – You’ll get points if you request 250,000 or less for RES or $125,000 or less for EEI

- State Director and Administrator Priority Points (10 points) – You can get additional points depending on veteran or socially- or economically-disadvantaged status, the type of technology used, geographic diversity, and more.

If you’re interested in learning more about the criteria, check out the USDA’s rubric here.

How Do You Apply for a USDA REAP Grant?

The grant application process is typically done by your solar installer or a third party. However, it does require a fair bit of input from you. This will include providing various financial information, information about the proposed solar energy system, and your approval and signature for multiple documents.

They’ll take on the nitty-gritty work, and they’ll do their best to ensure your application stands a good shot at earning the coveted grant. At Paradise Energy, we have grant writers on staff who have helped secure over $12 million in grant funds for our customers.

The Safer Option: 25%

We expect these six rounds of the USDA REAP Grant will be extremely competitive. If your project likely won’t score well, or if you’d feel better going for the sure thing, you can always instead opt to apply for a 25% grant. Also through the USDA via the Inflation Reduction Act, this program acts to provide grants for other efficiency-related projects for farmers and rural businesses. Because of its lower amount, we expect this to be much less competitive than the 50% REAP Grant.

When Should You Apply for a USDA REAP Grant?

There’s no doubt that a grant covering 50% of your system’s installation costs is huge. Coupled with other widely available incentives, 80% or more of your installation costs could be covered within the first year.

But there’s no guarantee the USDA REAP Grant will stay at this 50% level, and it’s not something you’ll want to miss. The current program only extends through the fall of 2024.

The best time to get the ball rolling on your solar system and grant application process is now. The sooner you submit your application, the more chances you’ll have of getting this grant.

That’s where we come in! Our team of grant experts has helped our customers secure over $12 MILLION in USDA funds. We’re ready to help you achieve the same. Contact us today to get started.

Last updated: July 2023