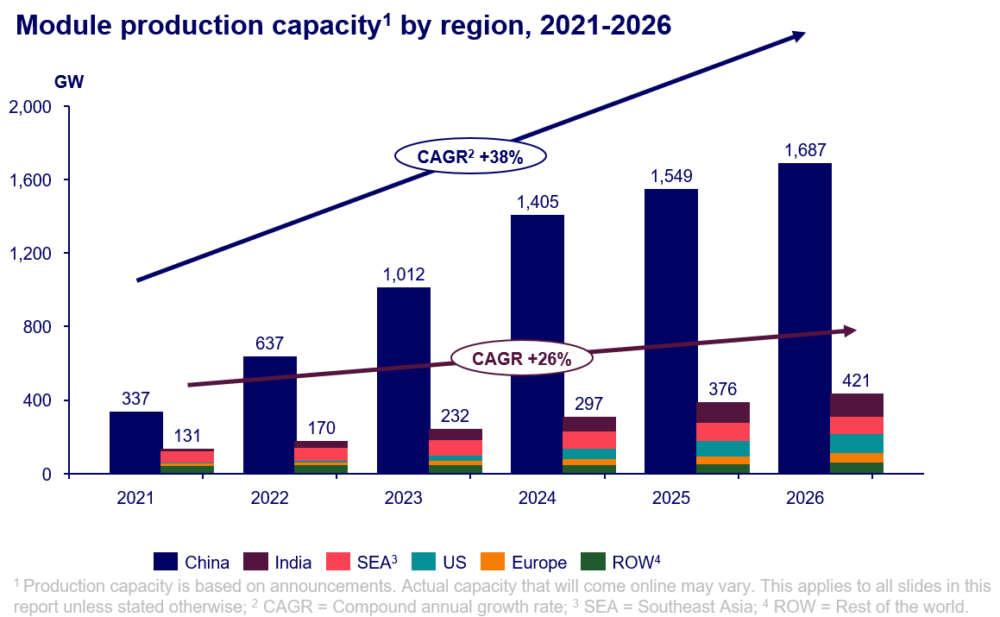

A new report from Wood Mackenzie states that China will hold more than 80% of the world’s polysilicon, wafer, cell and module manufacturing capacity from 2023 to 2026. The country invested over $130 billion into its domestic solar industry in 2023.

The report, “How will China’s expansion affect global solar module supply chains?” finds that more than 1 terawatt (TW) of wafer, cell and module capacity is forecasted to come online by 2024 within China, meaning that the country’s capacity is sufficient to meet annual global demand now through 2032.

“China’s solar manufacturing expansion has been driven by high margins for polysilicon, technology upgrades and policy support,” said Huaiyan Sun, senior consultant at Wood Mackenzie and author of the report. “And despite strong government initiatives for developing local manufacturing in overseas markets, China will still dominate the global solar supply chain and continue to widen the technology and cost gap with competitors.”

Strong government policies in overseas markets have started to increase local solar manufacturing, but they are still not cost-competitive compared to Chinese supply. A module made in China is 50% cheaper than that produced in Europe and 65% cheaper than those made in the United States, according to the report.

The United States and India have together announced more than 200 gigawatts GW of planned module capacity since 2022, driven by the Inflation Reduction Act (IRA) in the United States and the Production Linked Incentive (PLI) in India.

“Despite considerable module expansion plans, overseas markets still cannot eliminate their dependence on China for wafers and cells in the next three years,” Sun said.

China will continue to be the global technological leader with its announcements to build more than 1 TW of n-type cell capacity. This represents 17-times more capacity than the rest of the world.

Looking outside China, India is forecasted to overtake Southeast Asia as the second-largest module production region by 2025, which will be driven by India’s strong PLI incentives.

Oversupply and intense competition will characterize the solar supply chain going forward and is already driving cancellations of some expansion plans. Concerns about the market’s oversupply are mainly aimed at old production lines that produce lower efficiency products, such as the p-type and M6 cells. Demand for p-type cells began to decline in 2023, and Wood Mackenzie analysts expect it to be only 17% of supply by 2026.

“Oversupply will undeniably hinder some of the current expansion plans. More than 70 GW of capacity in China has been terminated or suspended in the past three months,” Sun said. The solar manufacturing industry in China is entering a challenging time. Module manufacturers will be forced to take orders at a loss, reduce capacity or shut down entirely.

News item from WoodMac