Residential solar took some serious hits in 2023. There were endemic supply chain disruptions and savings for rooftop solar became less clear when utility electricity prices stabilized in 2022. Solar stocks plummeted, and the passage of NEM 3.0 in California significantly curtailed the largest rooftop solar economy in the country.

In this environment, some residential solar contractors folded or laid off employees. Last year, New Mexico Solar Group, a mid-sized rooftop solar installation company, laid off employees before officially going out of business in August. The company was not alone. Warranty company Solar Insure reported an unprecedented 100 solar bankruptcies in 2023. The California Solar and Storage Association (CALSSA) estimated 17,000 solar employees were laid off in the state alone in a six-month period, with some companies cutting staff headcount by half.

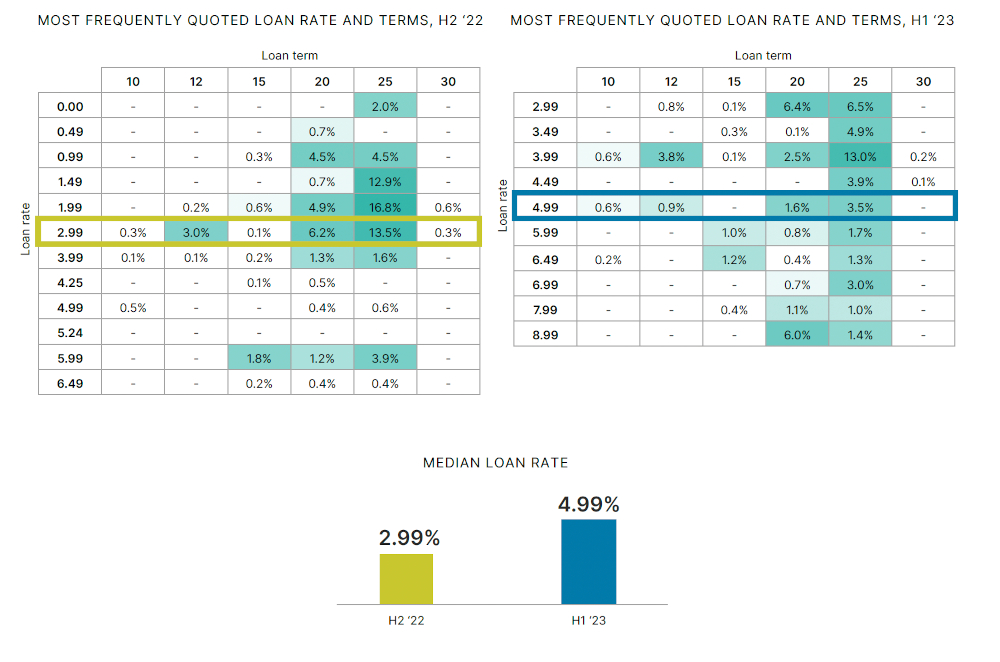

Rising interest rates have also caused solar financing terms to increase across the country. Spencer Fields, director of insights at solar marketplace EnergySage, noted that the average loan interest rate soared to nearly 6% in Q3 2023 (from 1.99% in Q2 2022), a significant development given that 70% of solar installations are financed with loans.

Rising interest rates have also caused solar financing terms to increase across the country. Spencer Fields, director of insights at solar marketplace EnergySage, noted that the average loan interest rate soared to nearly 6% in Q3 2023 (from 1.99% in Q2 2022), a significant development given that 70% of solar installations are financed with loans.

“When we recently asked a couple hundred solar installers how high interest rates were affecting their business, three out of four of them said these rates adversely impacted their business,” Fields said. New Mexico Solar Group cited the sudden rise in interest rates as one of the reasons for its closure.

Zoë Gaston, principal analyst of U.S. distributed solar at Wood Mackenzie, said high interest rates were “resulting in both loan and third-party ownership (TPO) product price increases and significant increases in loan product APRs. However, loan products are more sensitive to interest rate increases, and we are hearing that loan providers are finding it difficult to provide a compelling value proposition to customers in some states, depending on retail rates.”

Gaston said other major factors causing residential installers to close or lay off employees are higher cost of capital, significantly lower sales in some markets, higher customer acquisition costs and cash flow constraints from milestone payments being pushed later in the project lifecycle.

Credit: Solar Goat

In this tough economy, Fields noted the shrinking demand for “big ticket item” discretionary purchases for the home, such as solar. He also suggested that companies had been overly optimistic about 2023 growth and may have over-hired or expanded too quickly, leading them to contract when the expected growth did not occur.

Residential solar installers are looking for remedies. Fields predicted that many solar installers would seek new financing options such as TPO offerings and more affordable solar loans with lower dealer fees or origination costs. Solar installer Palmetto recently started offering leases and PPAs in response to the rising interest rates.

“Installers are focusing more on operational efficiencies and making the most of their current markets instead of expanding,” Gaston said. “Others are experimenting with pricing and product-offering tweaks and emphasize that product optionality for customers has been vital for maintaining growth this year.”

She also noted that Inflation Reduction Act “adders” will increase the TPO share in the residential solar market over the next few years and potentially change the value proposition in some state markets that have historically been less suitable for residential solar.

“We can take a long hard look at the cost of solar, sharpen our pencils and find a way to design more compellingly priced solar packages that work for homeowners,” Fields said.

This story is part of SPW’s 2024 Trends in Solar. Read all of this year’s trends here.