The consumption of electricity in homes has been increasing over the years. It varies from season to season. If a household gets an electricity bill of Rs. 2000 during the rainy season, it can easily go up to Rs. 5000 during hot summer days, which is expensive for a common man. The family also does not want to run ACs at free will and are more cautious when running an AC at home because he is scared of the high electricity bill. In such a situation, a homeowner starts looking for alternatives to reduce his electricity bill. One such super-effective alternative is the application of solar energy and generating free power. But people often face a few challenges when installing a solar system. These are:

i) No loan financing available for solar system installation and

ii) Availing Net Meters for the solar system.

Now let’s learn about how to face these challenges while installing a solar system.

Can we get a loan on the solar system?

Buying a solar system is just like buying any other product like a car. Come to think of it, the purchase and ownership of mobile phones, cars, or homes have become convenient these days due to the easy availability of loans and EMI options. Everyone knows how to buy mobile phones, cars, and homes on EMI but do you know how to buy a solar system on loan?

Anyone holding a credit card can easily avail the EMI option on a solar system, but do debit cardholders have this facility? About 80 crores Indians are bank cardholders, out of which nearly 30 crores people own Pradhan Mantri Jan Dhan Yojana debit card (ATM card). Only 50 lakh people i.e. approximately 1% have credit cards that allow them to avail EMI option on the installation of solar systems.

There are two ways of availing loans on a solar system.

Option 1: Buy Solar Panel on EMI with Debit Card

A few banks such as SBI, HDFC Bank, Axis Bank, ICICI Bank, Kotak Mahindra Bank, and Federal Bank have already made it easier to avail loan facility by allowing to check the Loan Eligibility Criteria.

A potential customer has to send an SMS like DCEMI<SPACE><last digits of Debit Card Number> to 56767, in case he has an account with HDFC bank. One should use the same mobile number to send this text message, as is registered with the bank. You will get a reply with your loan status on the same number. If you will be eligible, you will get a message regarding your eligibility amount in the message itself. The chance of loan approval is just 0.02% and the cardholder’s approval for a loan depends on the bank’s internal database/ criteria.

Similarly, you can try for other banks like:

– SBI Bank – SMS DCEMI to 567676 from your registered mobile number

– ICICI Bank – SMS DCEMI<SPACE><last 4 digits of Debit Card number> to 5676766

– Axis Bank – SMS DCEMI<SPACE><last 4 digits of Debit Card number> to 5676782

– Kotak Bank – SMS DCEMI<SPACE><last 4 digits of Debit Card number> to 5676788

– Federal Bank – SMS DC<SPACE>EMI to 9008915353 or give a missed call to 7812900900

Option 2: Way to Get Home Improvement Loan from the Bank

A few banks like the State Bank of India grants loans of up to Rs.1 lakh for home improvement with an interest rate of nearly 8%. The loan term is 4-5 years or more. A customer can avail of such loans for installing the solar system.

What does a customer need to avail of a loan for Home Improvement?

STEP 1. He needs to visit the nearest bank branch of his area and find out about the bank’s policy on the Home Improvement loan.

STEP 2. The next step is to contact any dealer or a distributor of a private solar company like Loom Solar in your area. They will give a quotation of the size of the solar system that the customer needs to install on their own letterhead. This letter is needed for availing of the loan.

STEP 3. Now the bank will transfer nearly 80% of the total price of the solar system to the private company’s reseller’s bank account. It might take around 5-7 days for the whole process.

STEP 4. Then the reseller of the private company will install the solar system at the customer’s premises. When the customer hands over the NOC to the reseller, the bank transfers the balance 20% to the reseller’s bank account.

What does a reseller need to do to install a solar system?

Any person or a small firm interested to start a business of installing solar systems should get in touch with private solar companies like Loom Solar. All they need is:

1. A shop

2. The GST number for that area

3. Free funds of Rs. 25,000 – 1,00,000 for investment.

If the above criteria are satisfied they can easily become a dealer or a distributor of a private solar company.

In short, you will know that how can you save your income tax using solar power? Many banks give home improvement loan for home decorations, such as buying furniture, solar panel installation, home painting, home reconstruction, buying home appliances, etc.

What are the Tax Benefits of Installing A solar system?

Any professional person who is working in a job and earns Rs. 5 lakhs or more in a year, they can claim tax benefits by treating solar system installation as an expense in their ITR.

Budget 2020 has announced a new tax regime giving taxpayers an option to pay taxes as per the new tax slabs from FY 2020-21 onwards.

| Total Income (Rs) | Tax Rate |

|---|---|

| Up to Rs 2.5 lakh | Nil |

| From 2,50,001 to Rs 5,00,000 | 5% |

|

From 5,00,001 to Rs 7,50,000 |

10% |

|

From 7,50,001 to 10,00,000 |

15% |

|

From 10,00,001 to Rs 12,50,000 |

20% |

|

From 12,50,001 to 15,00,000 |

25% |

|

Above 15,00,000 |

30% |

A potential customer can easily avail of a home improvement or Renovation loan from the bank in connection to installing a solar system in his house. It will be easier for him to get the loan if he already has a home loan with the bank as the bank will have proof of the customer’s credibility. In case, he does not have an existing home loan with the bank, he can still avail of the loan with relevant documentation. After he gets approved for the home improvement loan, the customer can claim it as an expense in his ITR as an exemption/ deduction from his total income.

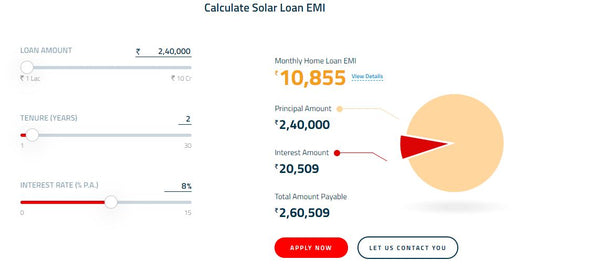

Suppose, there is a potential customer with monthly income of Rs. 75,000 (Rs. 9,00,000 per annum) who is interested in buying a Solar System. This customer has bought a 3kW Solar System for his home at Rs 240,000 on a home improvement loan. The Loan tenure (1 year to 30 years) will be determined on the basis of the person’s age. The customer can then negotiate his EMI plan as per his comfort and earnings. If the customer pays an EMI Rs 15,000 per month, then his annual EMI obligation will be Rs 180,000 and it will be subtracted from his total annual income. Now, the customer has to pay income tax on the balance (i.e. Rs. 9,00,000 – Rs. 1,80,000) Rs 720,000. For more information, you can contact the nearest loan department of the bank branch.

What are the risks involved in this job?

The major risk involved in this job is if a customer is unable to repay the loan amount to the bank, the bank will go to the reseller company for recovery.

2. Net Meter for the solar system

A net meter shows solar production (Export), grid consumption (Import), and net consumption.

What do you need to get a Net Meter?

There are 4 basic steps you have to follow for net meter. Below are given:

1. Check Sanctioned Load on Electricity Bill

If you need to install a net meter, you will have to check the sanctioned load of your electricity meter. A net meter must be a minimum of 3 kW capacity. If any customer has a net meter of lower capacity, he should first get it upgraded to 3 kW capacity. Once this is done, the customer can install nearly 80% of the approved meter capacity at his premises.

2.Visit Your Local Electricity Department

To find more about this, a customer might need to visit his electricity office.

3. Install Solar System in Your Home

Next he needs to purchase a solar system.

4. Install Net Meter

A net meter can be installed only after the installation of the solar system is complete.

Every state has a different net metering policy. To know more, click here.

List of Banks in India for Rooftop Solar Finance

In India, many banking and non-banking services offer easy solar finance for rooftop solar installation. Below is the list of banks that provide homes with solar loans / easy EMI,

1. HDFC Bank Rooftop Solar Finance

HDFC is the largest private sector bank of India in terms of its assets and market capitalization. It is the third-largest company listed by the Indian Stock Exchanges. HDFC Bank Limited offers banking and financial services to its customers and has its headquarters in Mumbai, Maharashtra. Find out more information here:https://www.loomsolar.com/blogs/rooftop-solar-finance/hdfc-home-loan-with-solar-rate

2. SBI Rooftop Solar Finance

The Government of India has set an ambitious target of installation of Grid Connected Rooftop Solar Photovoltaic (GC-RSPV) projects with capacity aggregating 40 GW out of total incremental target of 175 GW of Renewable Energy capacity by 2022. Find out more information here:https://www.loomsolar.com/blogs/rooftop-solar-finance/sbi-home-loan-with-solar-rate

Conclusion

The most common questions in installing a solar system are what will be the total cost, can I get a loan or EMI option and where can I get the net meters? You can contact Faridabad’s Loom Solar Company has installed grid-connected solar systems on loans and net meters at many customers’ home premises.