If you follow Solar Power World’s U.S. solar manufacturing news, you know the domestic manufacturing market has never looked stronger. And while that is true and many companies are looking to invest in new facilities in the United States, years-long planning and construction processes are suddenly being rethought, specifically in the panel manufacturing space. Most companies are still waiting to see final domestic-content ITC bonus rules from the Dept. of Treasury to determine what size factory is worthwhile. New U.S. module manufacturers are also questioning their competitiveness in a market flooded with considerably cheaper imported solar panels.

Still, companies exhibiting at Intersolar North America last week wanted to broadcast their support of the U.S. market. I asked every panel manufacturer that said it was involved in the U.S. market exactly what it was planning. Some companies were very open about their statuses, and others gave hardly any information. I have everything here for you to make your own conclusions.

Meyer Burger didn’t need to be loud at Intersolar because its actions in Europe told the story. The company announced it was suspending its operations in Europe, including one of Germany’s longest-running solar panel factories, due to a deteriorating European market. Instead, Meyer Burger will put all its focus into its solar panel plant in Arizona, which just began receiving equipment. The 2-GW factory will receive cells from Germany until the company’s cell factory in Colorado gets going.

No news is good news for Maxeon. The company is still planning to open a 3.5-GW solar cell and panel manufacturing site in New Mexico sometime next year. Maxeon is awaiting news on a potential loan from the Dept. of Energy, which company execs said they hope to hear about in the next few months.

SEG Solar is ramping its 2-GW solar panel factory in Houston, Texas. The company said it will begin testing modules off the line in June and hopes to begin commercial production in July 2024. SEG is getting its cells from Indonesia, and it would eventually like to bring that manufacturing to the United States. A previously announced junction box manufacturing partnership would likely fit on a portion of SEG’s solar panel factory floor.

Hounen Solar is finishing up a 1-GW panel factory in South Carolina. No other major details were provided, except that C&D Clean Energy is taking a portion of the capacity and white-labeling modules eventually.

Chinese company Toenergy claims that is starting a 500-MW solar panel factory in Sacramento. The company currently operates in Malaysia.

Chinese company Runergy confirmed it was supporting a 2-GW solar panel factory in Alabama under the Hyperion Solar brand name. The factory should begin production in April, Runergy said.

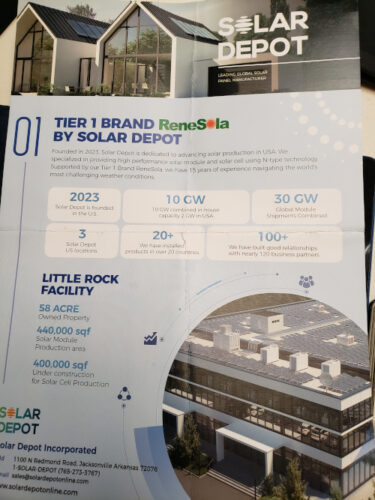

New company Solar Depot has a 440,000-ft2 building in Arkansas it says will begin making panels for the utility-scale market in June this year. The company is licensing ReneSola tech. No further information on megawatt capacity of the factory.

Indian brand Rayzon confirmed it is partnering with the previously announced Adion Solar to start panel manufacturing in the United States. The company has land outside Atlanta, Georgia, to build the factory but is waiting for final Treasury rules before pulling the trigger.

Turkish company Energate said it is building a 500-MW solar panel factory in West Valley, Utah, and expects production to begin in three months. Then the company will set its sights on an East Coast manufacturing hub in 2025. Energate panels are branded as AE Solar in Europe.

New company SolarLink said it’s starting a 2-GW panel factory in North Las Vegas, Nevada. The brand new building will likely host two assembly lines and 150 employees. SolarLink is fronted by the former COO of JA Solar.

Chinese company Phono Solar (with SUMEC Group) claims it will start a 1-GW panel factory somewhere in South Carolina by Q2 this year. The company also has manufacturing locations in Cambodia, Laos and Vietnam.

Solarever USA has operated a panel factory in Mexico for the last few years, but claimed at Intersolar it was assembling its 550-W, silver-frame module for the utility-scale market in the United States. Company reps could not say where the panels were being assembling or how big the factory was, but said Solarever owns the factory and is not an OEM.

Indian company Waaree announced late last year it was starting a 3-GW panel factory in Texas. Everything is still on track.

Finally, Solar4America’s South Carolina factory is almost complete. It is awaiting cell manufacturing equipment. The company’s California panel factory is producing as announced.