Solar panel systems offer many tangible benefits to businesses. They reduce a fixed cost, impart your environmental values to your community, and they can help you save big on taxes.

In this blog, we’re focusing on the tax benefits you can take advantage of by installing solar for your business.

What Tax Benefits Are Available For Commercial Solar Panels?

There are two main ways solar energy saves businesses money on tax day:

- the federal solar investment tax credit (ITC), and

- accelerated depreciation

Each works differently, but both keep more money in your bank account.

How Does The Federal Tax Credit Work for Commercial Solar?

The Solar Investment Tax Credit (ITC) saves businesses a substantial amount on solar installation costs through a tax credit granted by the US Federal Government. Qualifying companies can recoup 30% or more of their solar investment.

Here’s how it’ll work.

Solar Systems Under 1 MW AC Power

Systems under 1 megawatt (MW) AC power will receive a tax credit of at least 30% of installation costs. For most businesses, this is the guaranteed rate until 2025.

You could qualify for one or more adders, which increase the 30% credit.

- Energy communities (+10%): This aims to encourage the adoption of solar on some brownfield sites and in some communities with fossil-fuel-focused economies. Use this map to see where they are.

- Domestic content (+10%): To bolster American-made solar components, using domestic materials and equipment can save you more. However, it’s hard to find products that will qualify.

- Low-income areas (+10%): Businesses in areas that meet low-income qualifications can receive an additional 10% of the tax credit.

Solar Systems 1 – 5 MW AC Power

Systems 1 to 5 MW AC power will receive the full 30% tax credit as of the writing of this blog. However, once the IRS issues additional guidelines, things change.

Once in effect, the tax credit for these larger systems will start at 6%. If the project meets certain conditions, the tax credit can increase to 70%. These include:

- Prevailing wage (+24%): You can gain the 30% credit if the project meets apprenticeship and prevailing wage requirements.

Energy communities (10%): Same as above - Domestic content (10%): Same as above

- Low-income area (10%): Same as above

Larger systems have a second option. Instead of the ITC, you can choose a production tax credit (PTC). With this, you’ll earn credit for each kilowatt-hour (kWh) of electricity your system produces. The current rate is $0.026/kWh, but it’ll increase with inflation.

When Can Businesses Use The Solar Tax Credit?

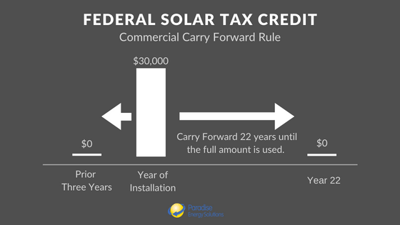

You don’t have to use the credit for the year you installed your system. There’s a 25-year window for when you can use your ITC.

You don’t have to use the credit for the year you installed your system. There’s a 25-year window for when you can use your ITC.

Businesses can apply the credit to taxes they owe for any year from three years before the installation and up to 22 years after the installation.

For example, if you installed a system in 2024, you could apply your credit to taxes owed between the years 2021 to 2046.

Does A Business Need To Owe Taxes To Use The Solar Tax Credit?

The ITC has existed for a long time, but it changed in the 2020s. Before, businesses had to owe federal taxes to qualify for the credit. However, in 2022, the introduction of a transferability program changed this.

It’s now possible for businesses to “transfer” (or sell) their solar tax credit to a third party with tax liability.

Because this is a relatively new incentive, support for these transactions is still developing. We expect to see firms and professionals specializing in brokering and administering these transfers very soon.

That said, we do have some guidance on how it’ll work:

- The owner of the system must register with the IRS to obtain a registration number.

- The tax credit can be transferred to multiple parties (e.g., one business purchases 40% and another purchases 60%).

- The credit can only be transferred once.

- It must be a cash transaction.

- You can’t transfer the credit to a related party (e.g., business partner, family member, etc.)

- If the system owner sells the system within the first six years, the transferee is responsible for any tax liability triggered by the solar system’s ownership change.

While some unknowns exist, this program makes solar more viable for even more businesses and nonprofits.

The Other Tax Incentive For Commercial Solar: Accelerated Depreciation

Like machinery, equipment, and buildings, your solar panel system will depreciate. And you can reap the benefits of this on your taxes.

Commercial solar panel systems qualify for accelerated bonus depreciation, which applies to federal depreciation only.

Here’s how it works for 2024:

- Year 1: You can take 60% of the solar system’s entire federal depreciation.

- Years 2 – 6: The remaining 40% will follow the five-year MACRS (Modified Accelerated Cost Recovery System) schedule.

State-level depreciation benefits will follow the standard five-year MACRS schedule.

How Much Money Can You Save with Accelerated Depreciation on Commercial Solar?

The savings from depreciation will depend on the cost of your system and your federal and state tax brackets. That said, it can cover a significant portion of the installation cost.

In one example, for a $300,000 system, a 24% federal tax rate and a 7% state tax rate saved 26.3% of the system’s entire cost ($79,050).

Determining the Basis of Depreciation with the Solar Federal Tax Credit

The federal investment tax credit can reduce the cost of going solar by 30% or more. But is the cost basis for the depreciation of your solar system calculated before or after the ITC?

The IRS splits the difference with you. That means if your tax credit is 30%, the depreciable basis would be 85% of the total cost (100% – [30% x .5]). So if your system costs $100,000 to install, you’d depreciate on $85,000.

If you opt for the production tax credit (PTC) over the ITC, your depreciable basis will not be reduced. You can depreciate the full 100% of the system’s cost — not just 85%. However, the PTC typically only makes sense for very large, utility-scale systems.

The Future of Accelerated Depreciation Benefits for Commercial Solar Panels

Accelerated deprecation is slowly being phased out. Beyond 2024, the 60% first-year bonus will drop each year in increments of 20%. In 2025, you’ll be able to take 40%. In 2026, it’ll be 20%, and in 2027, it’ll be 0%.

The amount you’ll receive for depreciation won’t change as it’s phased out, but the time at which you receive it will. In 2027, all depreciation on the system will follow the five-year MACRS schedule.

How Will Solar Impact Your Business’s Taxes?

Between the ITC’s 30%+ savings and accelerated bonus depreciation, installing solar can instantly add savings to your business’s bottom line.

Want to know how much going solar can save your business? Request a free consultation today.

Or, use our Solar Savings Calculator to get an instant price and savings estimate.