A Cambodian contract manufacturer for many Chinese Tier 1 solar panel companies is bringing its own brand of panels to the United States, with plans to start a 1.5-GW solar panel assembly factory outside Houston this September.

Imperial Star Solar, a company with Chinese origins, has been operating a 2-GW cell, 2.5-GW solar panel manufacturing campus in Phnom Penh, Cambodia, since 2020. The company has made panels through OEM/ODM relationships for companies like Longi and Canadian Solar, and those efforts will continue in Cambodia. But now, Imperial Star is putting the rest of its focus on the U.S. market, said Keer Zhuo, executive VP and head of U.S. operations.

Imperial Star Solar, a company with Chinese origins, has been operating a 2-GW cell, 2.5-GW solar panel manufacturing campus in Phnom Penh, Cambodia, since 2020. The company has made panels through OEM/ODM relationships for companies like Longi and Canadian Solar, and those efforts will continue in Cambodia. But now, Imperial Star is putting the rest of its focus on the U.S. market, said Keer Zhuo, executive VP and head of U.S. operations.

“Most people probably haven’t heard of us, but all the companies we’ve worked with and all the product we’ve been supplying has been reaching a lot of big U.S. clients already,” she said. “We have a large focus in Southeast Asia, but we are now strategically pivoting toward the U.S. market.”

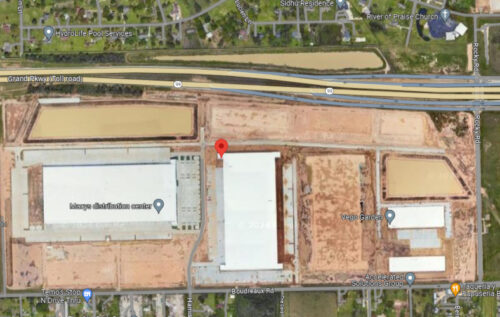

Imperial Star has leased a 384,500-ft2 factory in Tomball, Texas, a half-hour north of downtown Houston. Zhuo said the facility should support 300 jobs with a Phase 1 annual capacity of 1.5 GW. Phase 2 would boost capacity inside the large factory.

The Texas factory will initially make PERC panels, as those are the cells available from Imperial Star’s Cambodia factory. At the same time, the manufacturing sites in Cambodia will begin shifting to TOPCon designs, and the Texas factory will eventually switch too.

Imperial Star was included as one of the companies determined by the Dept. of Commerce to be circumventing Chinese antidumping duties by working in Cambodia, and products from Imperial Star’s Cambodian campus will enter the United States with AD/CVD tariffs beginning in June 2024 after President Joe Biden’s tariff-pause is lifted. Zhuo said the company is opening a silicon wafer factory in Laos in Q2 2024 that should begin shipping products in Q3. If Imperial Star’s Cambodian-shipped products do not use Chinese wafers, they’re no longer tariffed under the AD/CVD rules.

“With the AD/CVD kicking in in June this year, having no Chinese wafer is going to help us be fully protected,” Zhuo said.

Imperial Star is working on its own internal environmental, social and governance (ESG) guidelines to be better representatives within the solar industry.

“We’ve been working really hard on the ESG side. It’s a little challenging in Cambodia because there are not very clear guidelines or standards. But we’re putting a strict internal standard to meet our internal ESG plans,” Zhuo said. “We’ve been working within UFLPA and pushing really hard with our vendor suppliers in terms of polysilicon and wafers. We’ve tried to have the full-traceability documents and monitor every step of our raw materials, beating our internal commitments and standards.”

“We’ve been working really hard on the ESG side. It’s a little challenging in Cambodia because there are not very clear guidelines or standards. But we’re putting a strict internal standard to meet our internal ESG plans,” Zhuo said. “We’ve been working within UFLPA and pushing really hard with our vendor suppliers in terms of polysilicon and wafers. We’ve tried to have the full-traceability documents and monitor every step of our raw materials, beating our internal commitments and standards.”

Zhuo said the “young and ambitious” U.S. team is excited to quickly get Imperial Star’s Texas plant running. She said the group looked at other supportive manufacturing states, like Ohio and Georgia, but ultimately chose the Houston region for its U.S. operations.

“The biggest reason we chose Texas, given our aggressive timeline, they do have a lot of empty, brand new buildings. Second, is the labor. Houston has that advantage of labor in solar manufacturing. Also, it’s more of a synergy — a lot of companies are entering Houston as solar manufacturing hubs. That’s going to help us leverage some of the low-coast supplier vendors,” Zhuo said.

Imperial Star Solar joins NE Solar as Cambodian solar panel manufacturers announcing plans to set up U.S. manufacturing operations.