Solrite Energy says its new power purchase agreement has more agreeable finance terms due to the ability of distributed solar-plus-storage to make money as part of a virtual power plant.

Solrite Energy is rolling out a new finance package for residential solar-plus-storage, claiming its enhanced terms are directly tied to the benefits derived from virtual power plants (VPP).

Using the advanced technical capabilities of sonnen’s energy storage hardware, their power purchase agreement (PPA) aims to tap into the growing potential of VPPs, offering homeowners in selected regions a way to participate in energy markets.

According to a press release shared with pv magazine USA, Solrite Energy’s PPA is now accessible to homeowners in California, Puerto Rico and Texas. The company is planning expansions into New York, New England and Hawaii later this year. These regions offer opportunities for homeowners to integrate their residential solar and storage systems into the broader power grid. This integration occurs during periods of high demand, allowing homeowners to generate revenue by providing grid services.

For example, in Massachusetts and Rhode Island, the National Grid’s ConnectedSolutions program seeks to pay energy storage owners up to $400/kW during high grid demand events in Rhode Island, and $225 in Massachusetts. Similarly, Eversource, another major utility in Massachusetts, offers a similar program.

Sonnen recently updated its energy storage systems to be “NEM Proof,” specifically tailoring its technology to thrive under California’s net energy metering 3.0 electric rate environment. This update introduces an optimized time-of-use solution, designed to maximize value for homeowners by strategically managing energy storage and consumption. Solrite says homeowners will also have access to the battery’s backup features.

Solrite is actively recruiting contractors via its website to offer its finance and technical product to end users.

While Solrite states that its offering is a market-first, it’s likely that national residential solar companies like Sunrun and Sunnova have previously adjusted PPA pricing to reflect additional revenue streams. However, Solrite distinguishes itself as the first to explicitly market its PPA as more advantageous, directly attributing the improved pricing to revenues generated from VPPs.

Sonnen has been a pioneer in harnessing battery assets for power grid support via its “sonnen communities,” with the inaugural community established in 2015. By 2018, the company achieved prequalification from TenneT, enabling it to engage in Germany’s primary control energy market with its solar-plus-storage network.

In the United States, Vermont’s Green Mountain Power took the lead in utilizing distributed assets to aid the power grid. The utility reported that 500 distributed Tesla Powerwalls, alongside two larger energy storage facilities, collectively saved its customers $500,000 over the summer by alleviating demand during peak hours.

The Tesla Powerwalls, through a collaborative agreement between the utility and homeowners, are installed in private residences. This initiative has successfully expanded to include several thousand units.

In 2019, Sunrun was the first residential solar asset owner to win the right to earn revenue from their installations through a “solar as a service” model, when the company was awarded a contract to contribute grid services in the NEISO power grid region. This has opened up the possibility of offering customers enhanced contract terms, potentially sharing some earnings. In the fall of 2022, the asset network was turned on for the first time, leveraging around 5,000 residential solar-plus-storage systems, delivering over 1.8 GWh of energy during times of peak demand.

Following regulatory approval, Tesla launched its inaugural VPP in Texas, establishing networks that leverage solar energy and Powerwalls to support the grid.

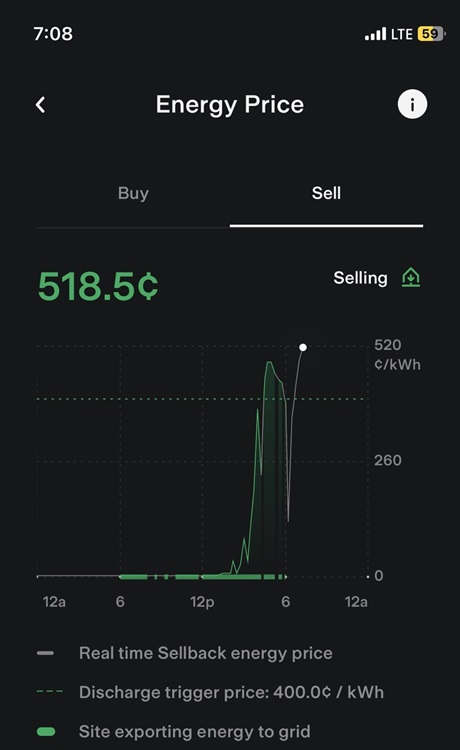

During the summer of 2023, Tesla Powerwall participants in the company’s new VPP began seeing revenues during peak-demand periods, with some reporting total earnings over $400, triggered when electricity prices reached $4/kWh.

Sunnova’s initiative to launch a “microutility” in California, aimed at equipping neighborhoods with their own power and comprehensive grid services, was unfortunately not approved. However, such forward-thinking proposals hint at the transformative potential awaiting the energy sector’s future.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.