There were two linked and highly consequential March developments in the Electric Reliability Council of Texas (ERCOT), the grid operator that serves about 90% of the electricity demand in Texas.

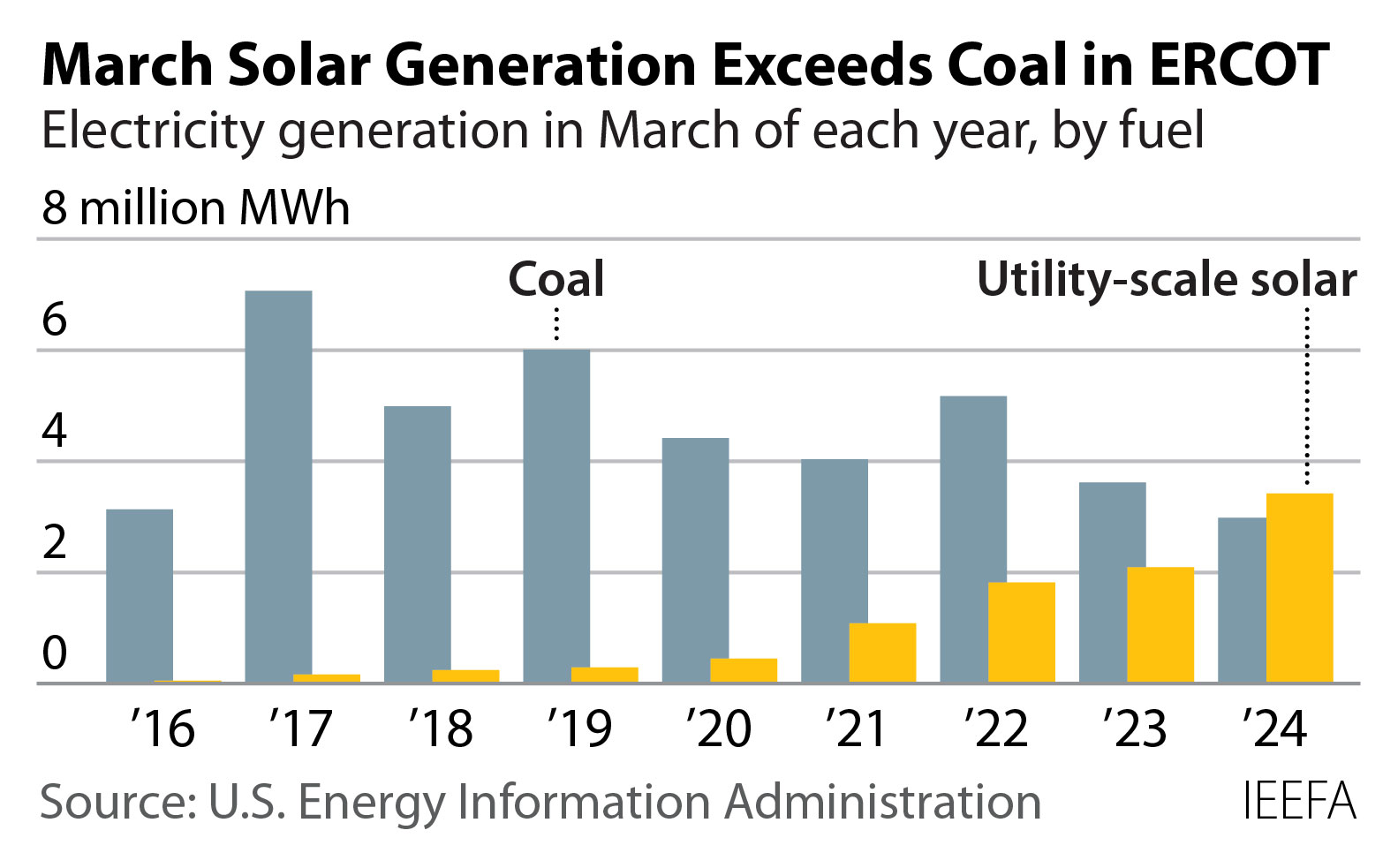

First, solar generation topped coal’s output for the first time in any month, sending 3.26 million MWh onto the grid vs. the 2.96 million MWh supplied by coal. Second, coal’s market share fell below 10% for the first time ever, to just over 9%. The decline continued a long-term slide that began a decade ago but that has picked up speed since 2016-17, when solar first showed up in ERCOT’s generation data.

For all of 2017, solar generated just 0.6% of ERCOT’s demand, or 2.26 million MWh. In March 2024 alone, solar generation reached 3.26 million MWh, according to the Energy Information Administration’s (EIA) hourly grid monitor. The increase pushed solar’s share of ERCOT generation to more than 10% for the month, also a first.

While solar has been climbing steadily (see the graphic below), there has been a notable pickup lately. Generation in March 2024 was 1.17 million MWh more than a year ago, a 56% increase, and the growth will continue. ERCOT data shows that the system currently has 22,710 MW of operational solar capacity but is expected to expand by almost one-third by the end of the year as another 7,168 MW of capacity is added. The figure counts only projects that have a signed interconnection agreement and have set aside the financing required to get onto the ERCOT grid. More growth is on tap for 2025, where projects with 20,932 MW of capacity are in a similar stage of development. There are thousands of additional megawatts of solar capacity in earlier stages of development.

In contrast, coal’s share of the ERCOT market has been falling, almost in reverse lockstep to solar’s growth. From 2003 through 2014, coal’s annual share of ERCOT demand ranged from 36% to 40% (except for 2012, when low prices increased gas generation and coal dropped to a 33.8% market share). Since then, the decline has been rapid. The last year coal topped the 30% mark was 2017; by 2018, coal had dropped below 25%; was under 20% in 2020; and was less than 15% last year, supplying just 13.9% of the system’s total demand.

Importantly, the annual average is not being skewed by a couple of months of extremely low generation. Rather, coal’s market share in ERCOT is declining across the board, even during the sweltering summer months. No month topped 20% in 2022, and only November marked more than 15% in 2023. The trend is not likely to change in 2024. Data for the first three months put coal’s market share at 16.1% in January, 10.3% in February and March’s first-ever sub-10% level.

Coal’s decline in ERCOT has important implications for the U.S. overall, since Texas has long been the largest user of coal for power generation. In 2023, the state burned 50.7 million tons of coal for electricity — twice as much as second-place Missouri’s 24.1 million tons — and 13% of the U.S. total. Data from the EIA grid monitor (see graphic below) shows that coal’s share of national electric generation was less than 15% every day in March — the first time that has happened. Coal’s national market share also hit a daily record low on March 29, dropping to just 11.25%.

Coal’s poor March performance is notable because in recent years it has been April and May — with moderate temperatures, longer days and steady winds — when its national market share has been at its lowest, and it is entirely possible that it could fall into the single digits on some days this spring.

These shifts in power production — solar’s increasing role, and coal’s declined in the nation’s most power-hungry state — show just how substantial the changes have become in the energy transition.

News item from the Institute for Energy Economics and Financial Analysis (IEEFA)