The International Energy Agency (IEA) Photovoltaic Power Systems Programme (PVPS) has published a wide-reaching snapshot of the global PV market, covering installations, manufacturing, policy trends, and grid integration.

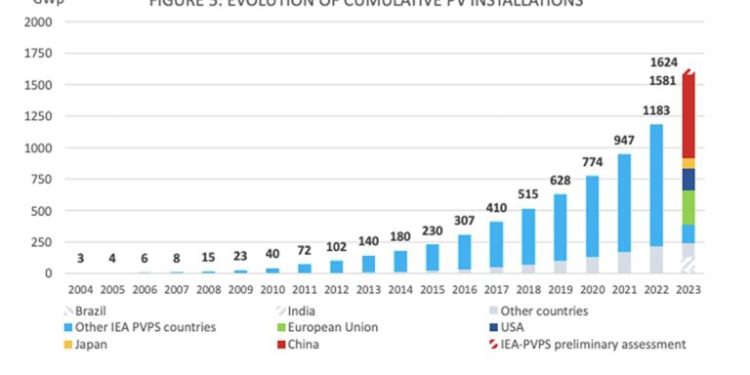

Global PV capacity grew to 1.6 TW in 2023, up from 1.2 TW in 2022, according to the IEA-PVPS Snapshot of Global PV Markets 2024.

The analysts said that up to 446 GW of new PV systems were commissioned last year, largely driven by rapid growth in China, alongside an estimated 150 GW of modules in inventories throughout the world.

“After several years of tension on material and transport costs, module prices plummeted in a massively over-supplied market, maintaining the competitivity of PV even as electricity prices decreased after historical peaks in 2022,” said the IEA-PVPS.

The report said that the oversupply of PV modules last year “shed light on the difficulties to align production and demand in a very versatile environment.” It noted that while production capacities increased significantly in China, growth only happened in a limited number of countries beyond China.

“Uneven political support in some markets could also be attributed to the difficulties to develop local PV manufacturing facilities in an already inundated market,” the report said, explaining that significant drops in PV module prices due to increased inventory, oversupply and competitive environment among manufacturers also caused strain on local manufacturing.

Elsewhere in the report, the IEA-PVPS said that both the rooftop and utility-scale segments grew in 2023. Approximately 45% of new capacity was on rooftops, continuing gradual growth seen since 2018 as rooftop markets opened in new countries, while decreasing installation costs and higher consumption costs made it more accessible for residential investors. The report noted that prosumers are becoming more active market drivers across the world, while noting a move away from net metering as PV costs go down.

The number of countries with theoretical penetration rates above 10% doubled last year, to 18. Spain, the Netherlands, Chile and Greece led in this metric, but more populous countries such as Germany and Japan also passed 10% for the first time.

The IEA-PVPS said that with increasingly high PV penetration rates in more countries, transmission and distribution system operators are having to “anticipate and more actively manage PV.” In some smaller regions, penetration rates were so high that rooftop solar provided 100% of power over several hours multiple times.

The report also noted that policy support for batteries is advancing, especially in countries with grid congestion, high penetration rates or high electricity costs. The report warns grid congestion and longer delays for grid connection in some countries is not allowing local markets to develop to full potential. The IEA-PVPS said the cost burden of managing, reinforcing and renewing grid infrastructure is becoming “one of the more sensitive topics.”

“As penetration rates increase, new governance models compatible with market and climate policy driven deployment targets will need to be established to ensure PV can be smoothly deployed,” the report said.

Looking at solar amid the broader energy transition, the IEA-PVPS said that PV is playing a “major role” and in 2023 represented more than 75% of all new renewable electricity technologies, which it attributes to consistent cost reduction, technical performance and accessibility, and generally faster permitting procedures than wind or hydro.

The latest IEA PVPS report follows publications on Germany’s end-of-life PV modules treatment chain, grid integration measures, and vehicle integrated photovoltaics, all released earlier this year.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.