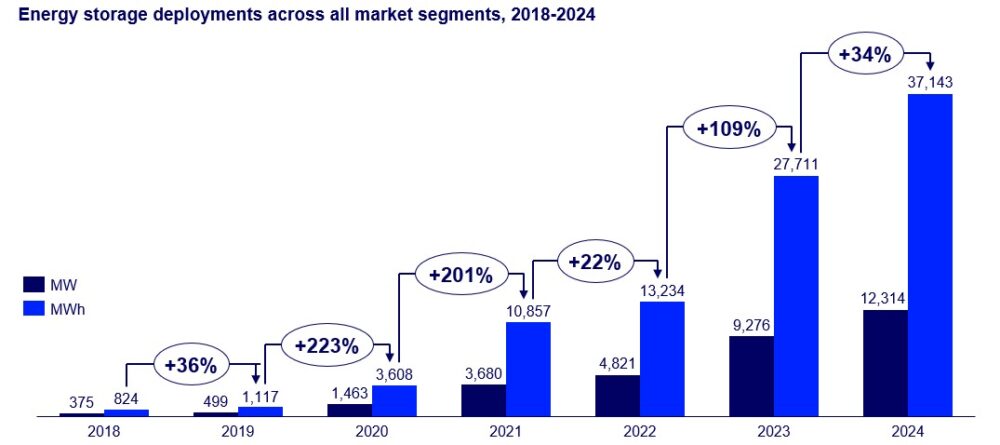

The U.S. energy storage market set a new record in 2024 with 12.3 GW of installations across all segments, according to the latest “U.S. Energy Storage Monitor” report released by the American Clean Power Association (ACP) and Wood Mackenzie. The report shows a total of 12,314 MW and 37,143 MWh deployed, representing increases of 33% and 34% respectively over 2023 numbers.

While Q4 grid-scale energy storage deployments were down 20% compared to Q4 2023, this was primarily due to the delay of 2 GW of projects in late-stage development from Q4 2024 to 2025. Texas and California continue to lead the market, with 61% of the total installed capacity in Q4, while the remaining 39% was installed across 13 states, expanding storage deployment beyond the leading markets. Grid-scale storage installations are forecasted to reach 13.3 GW in 2025.

“After another year of record deployment, energy storage is solidifying its place as a leading solution for strengthening American energy security and grid reliability in a time of historic rising demand for electricity,” said ACP VP of Energy Storage Noah Roberts. “The energy storage industry has quickly scaled to meet the moment and deliver reliability and cost-savings for American communities, serving a critical role firming and balancing low-cost renewables and enhancing the efficiency of thermal power plants.”

The residential storage market exceeded 1,250 MW in 2024, marking its highest year on record and 57% above 2023 totals. A record-breaking 380 MW of residential storage was installed in Q4 2024, a 6% increase over the previous quarter. Meanwhile, 145 MW of community-scale, commercial and industrial (CCI) storage was installed in 2024, a 22% increase over the previous year. California, Massachusetts, and New York accounted for 88% of installed CCI capacity.

Forecasted installations for 2025 have increased 7% over last quarter’s forecast. Across all segments, 15 GW of storage is expected to be installed this year, marking a 25% increase over 2024.

“Activity has been strong and our forecast for this year has expanded,” said Allison Feeney, research analyst at Wood Mackenzie. “However, due to policy uncertainties, growth will likely slow down this year and in subsequent years. Growth will pick back up toward the end of the decade, with a projected 81 GW total installations from 2025 to 2029.”

Allison Weis, global head of storage of Wood Mackenzie noted that the uncertainties surrounding the continuation of current tax incentives and the implementation of tariffs could change the long-term outlook.

“It’s still too early to determine the final form of IRA tax incentives over the coming year,” said Allison Weis, global head of storage for Wood Mackenzie. “The combination of new tariffs on China and other countries with continued 45X and domestic content bonus adder incentives would make US-based systems more competitively priced. However, many domestic providers are not set up to meet quick demand. If higher pricing is combined with ITC tax incentives phasing out beginning in 2028, it could lower our five-year deployment outlook by as much as 19%.”

News item from Wood Mackenzie