Solar marketplace platform EnergySage released its 21st “Solar & Storage Marketplace Report” showing data and trends for the first half of 2025. The report analyzes data points from homeowners shopping on EnergySage.com. Additionally, this year’s report includes EnergySage’s annual “Electrification Contractor Survey,” fielded in January to March 2025.

After a strong 2024 that drove residential solar and storage prices to all-time lows, the report found that the first six months of 2025 brought both momentum and uncertainty to the solar industry. Homeowner interest remains strong on the EnergySage platform, but shifting federal policies, tariffs and tightening trade restrictions are creating headwinds that contractors and installers are already feeling.

Three key insights from the intel report:

Residential solar prices remained at historic lows; storage costs rose modestly: Solar installations maintained their record-low median price of $2.48 per watt in H1 2025 on the EnergySage website, unchanged from H2 2024. Meanwhile, storage prices increased by 4%, as tariffs on Chinese battery components took effect, marking the first increase after two years of declining prices.

“Although we expect changes to federal tariffs and trade policies to affect prices in the second half of 2025, the snapshot from the first half of the year shows us that, with the right public policy, solar is accessible to many homeowners now — and will continue to be in the future,” said Emily Walker, director of insights at EnergySage.

Financing landscape shifts as third-party ownership gains strategic advantage: Median loan rates climbed to 7.5% in H1 2025 on the EnergySage website, with 38% of contractors reporting decreased loan demand as customers sought alternatives to high-rate financing, while 94% of installers reported that cash buyers increased or remained stable. Because HR1 protects tax credits for third-party ownership (TPO) longer than for purchased systems, it is positioned for significant growth in 2026.

“Even as higher interest rates have made traditional loan financing less attractive, we’re seeing that demand for solar hasn’t gone away, it’s simply shifting,” Walker said. “We expect attractive new financing models to emerge next year, which will keep residential solar adoption moving forward.”

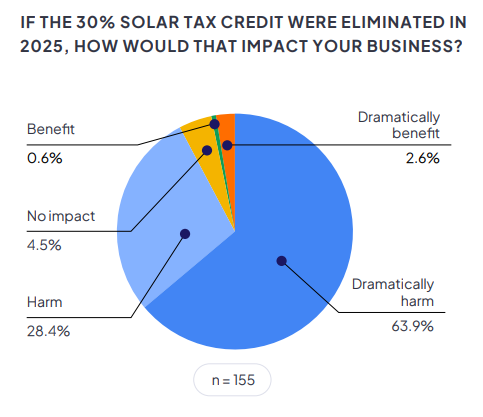

Contractors expressed widespread concern about industry headwinds: 92% of contractors surveyed by EnergySage expected the loss of the federal solar tax credit to harm their business, while 70% anticipated negative impacts from potential equipment tariffs. With 36% already reporting reduced profitability from higher interest rates, 84% citing higher labor rates in the past year, and 79% heavily dependent on solar-related revenue, many installers must adapt their business models to prepare for the post-tax credit environment.

Contractors expressed widespread concern about industry headwinds: 92% of contractors surveyed by EnergySage expected the loss of the federal solar tax credit to harm their business, while 70% anticipated negative impacts from potential equipment tariffs. With 36% already reporting reduced profitability from higher interest rates, 84% citing higher labor rates in the past year, and 79% heavily dependent on solar-related revenue, many installers must adapt their business models to prepare for the post-tax credit environment.

“Solar contractors across the country have voiced deep concern about what lies ahead for the industry,” Walker said. “With key incentives set to change, many are already rethinking their business models in order to adapt and remain competitive. The companies that find new ways to reach homeowners and offer value will be best positioned to weather this transition.”

“The solar industry is approaching a watershed moment, with homeowners eager to install solar and contractors bracing for the impact of the One Big Beautiful Bill Act,” said Josh Levine, EnergySage chief marketing officer. “During this transition, EnergySage remains committed to serving as a trusted resource for both homeowners and installers, offering expert advice, research, and perspective to help the industry navigate what comes next.”

News item from EnergySage