RE+, U.S. solar industry’s largest trade show, and its first since the Trump Administration passed HR1, has wrapped for this year. While an official number hasn’t been released yet, Abigail Ross Hopper, CEO and president of the Solar Energy Industries Association, said the event had drawn more than 35,000 attendees as of Wednesday, and broke its record for number of exhibitors. So, despite policy changes that have caused a wave of high-profile closures and a significant reduction to the projected domestic project pipeline, the U.S. solar industry still showed up in Las Vegas this week.

I’ve written about racking and mounting technologies in Solar Power World for nearly seven years, and much of my time at trade shows is spent talking to people from those companies. This year was no different. I met with more than 30 of them over two days.

Racking and mounting manufacturers, like the rest of the U.S. solar industry, are reconfiguring their approach for a post-IRA market. There is a shift from selling PV technology with the help of incentives and instead touting its standalone economic appeal in an era of rising energy prices.

Racking producers in the commercial and utility space are still enjoying some time with the investment tax credit, while residential manufacturers are facing a narrower window before it’s gone.

Racking up residential

There is an immediate demand for solar among homeowners as the residential ITC ceases at the end of this year. In response, many residential racking manufacturers were focusing on showcasing what they had in stock for these projects at the show instead of reinventing their products.

SnapNrack has locked its product pricing through the end of Q4 to stay cost competitive while the subsidy remains. “Solar should be a necessity regardless of whether or not you’re getting an incentive,” said Dakota Dominguez, senior marketing manager at SnapNrack.

However, residential racking isn’t a stagnant technology. There were still novel ideas for these rooftop solar structures.

Martin Solar Dual-Channel Solar Rail

Martin Solar, a subsidiary of 50-year-old Martin Roofing, produces roof mounts that attach along the glue tab on an asphalt shingle that are hidden under the proceeding shingle flap. The company has started producing Dual-Channel Solar Rail, which was designed to house system cabling separate from other components on the array while maintaining cable access for maintenance.

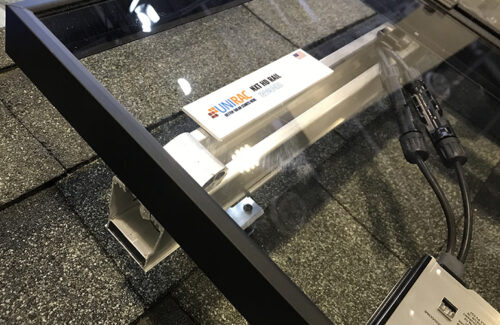

Unirac NXT HD Rail

Unirac debuted its NXT HD Rail, a reinforced mounting rail that, in addition to increasing row spans by 2.5 ft (to 10.5 ft total), has greater resistance to wind pressures and is better suited for larger modules. NXT HD is scaling into commercial applications and Unirac is producing the rail for public use now.

Many of the larger rooftop racking companies serve both the residential and commercial markets, and some working solely in the former are planning to expand.

Commercial opportunities

Federal subsidies remain intact for the commercial and utility markets through 2027, so the push to sell as much as possible within that timeframe isn’t as urgent as it is in residential. So, racking companies that traditionally worked in residential are eyeing commercial.

Pegasus FX

Pegasus unveiled its first commercial solar racking, FX, at RE+ this year. The company had until this point produced mounts and racking strictly for residential. FX is a flat roof racking designed to work in east-west, south-facing or flush system layouts. The system is direct attach only and is tested to withstand up to 180 mph winds.

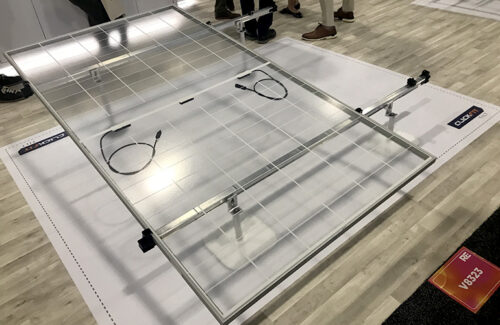

EcoFasten ClickFit

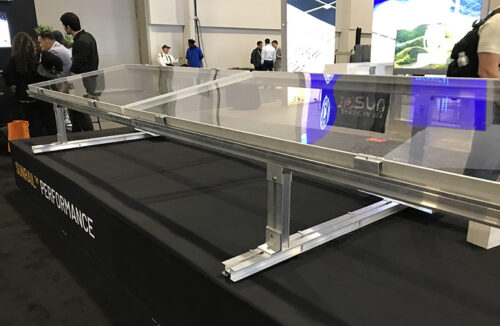

OpSun SunRail

Three companies I met with are producing elevated solar racking for commercial rooftops. ISA Corporation has manufactured these structures since 2010 with the purpose of leaving ample fire access clearance, reaching the roof line and residing over roof obstacles, like HVAC systems. While not as tall, but still higher than most, OpSun and EcoFasten both showcased elevated flat roof racking designed to clear roof obstacles and encourage bifacial module gains.

Tracker company expansions

The product advancements among tracker manufacturers largely center on the same issues: weather damage prevention (primarily hail) and building on uneven project sites. The bigger updates from these companies are that they’re branching into building accessory components and complementary services at a proprietary or acquired level.

Nextracker PowerMerge

Nextracker’s latest product wasn’t a tracker at all, but a prefabricated, simplified trunk connector for managing cable runs. The company went public with NX PowerMerge last week, sandwiched between acquisition announcements of both Origami Solar, a steel frame manufacturer for PV modules, and OnSight Technology, launching an O&M robotics division.

Array Technologies has entered the foundations market by acquiring APA Solar Racking. Darin Green, CRO at Array, said both companies had worked together on projects before, and as the tracker manufacturer targets new territories, APA’s foundations will assist with tougher soil conditions.

Terrasmart

Terrasmart produces ground-mount racking, solar trackers and ground screw foundations for those structures, and maintains a suite of electrical balance of system and project design technologies. Terrasmart’s expanded its eBOS offerings with a junction box that has built-in windows for infrared readings and electrical test ports, and both are accessible without opening the box.

OMCO Star Tracker Controller

OMCO Solar manufactures fixed-tilt racking and trackers across its five U.S. factories. The company showcased its Star Tracker Controller last year, which has now come to market. Star is a long-range tracker controller with an increased operating range of one mile, which drastically reduces the number of controller units needed on a project.

For more from RE+:

Read Kelsey’s inverter coverage from the show floor.